Support Blog

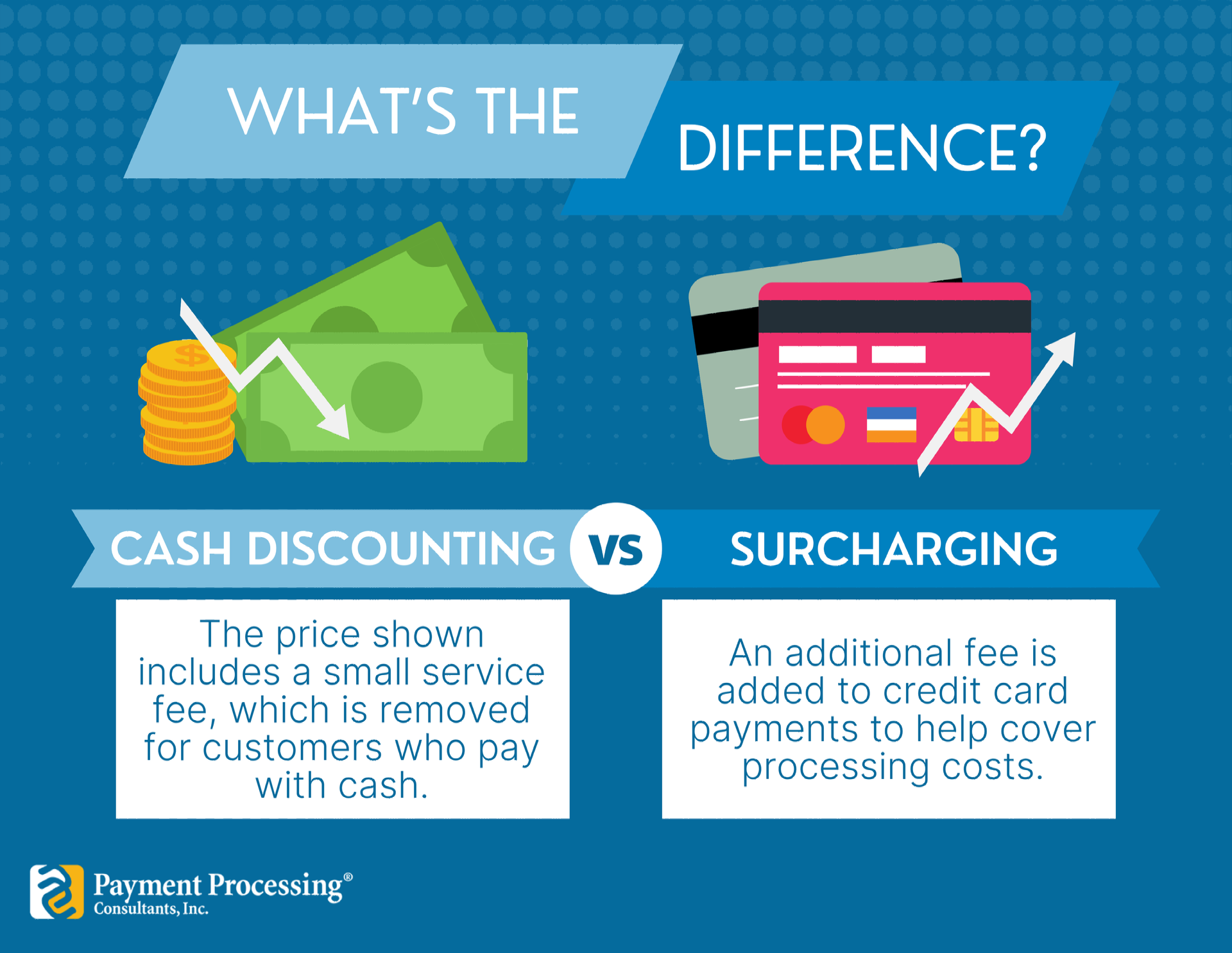

For business owners navigating the complex world of payment processing, understanding the strategies around credit card fees is crucial. Two popular strategies, cash discounting and surcharging , allow businesses to manage processing costs and incentivize payment preferences. Each approach has distinct characteristics, benefits, and legal considerations, so choosing the right one for your business can impact customer satisfaction and operational costs. This article will break down the differences between cash discounting and surcharging, helping you determine which option best suits your business needs. What is Cash Discounting? Cash discounting is a program where a business offers a discount to customers who pay with cash. Rather than adding a fee for credit card payments, it simply provides an incentive for using cash, reducing the overall transaction cost for customers who don’t use credit cards. How it Works : The listed prices reflect the credit card price, and a discount (often 3-4%) is applied when a customer chooses to pay with cash. This discount effectively lowers the price for cash-paying customers while maintaining standard pricing for those using cards. Benefits for Businesses : Cash discounting can help reduce processing fees, as more customers may opt to pay with cash to receive the discount. This approach also avoids passing on any additional charges directly to credit card users, which can foster a positive customer experience. Customer Perspective : Cash-paying customers enjoy a lower price, which can be an attractive option. Meanwhile, credit card users pay the listed price without feeling an added “penalty” for using their card. Legal Considerations Cash discounting is legal in all U.S. states, but it’s essential to comply with federal regulations and the terms set by card networks. Business owners must ensure the advertised price is the credit card price and that the cash discount is clearly displayed at the point of sale. What is Surcharging? Surcharging is the practice of adding a fee to the transaction total when a customer pays with a credit card. This fee, usually a percentage of the transaction amount (typically 1-4%), is designed to cover the cost of credit card processing fees, allowing the business to offset these expenses. How it Works : The business adds a surcharge fee to the transaction amount if the customer chooses to pay with a credit card, effectively passing the processing cost to the cardholder. Benefits for Businesses : Surcharging can directly offset credit card processing fees, which can result in significant savings for businesses that see high volumes of credit card transactions. By shifting the cost to credit card users, businesses can preserve their profit margins. Customer Perspective : Customers who pay with credit cards may feel the impact of the added surcharge. While this approach can help cover fees, it may be less appealing to customers who expect to pay the listed price without additional costs. Legal Considerations Surcharging is legal in many states but is restricted or banned in some (e.g., Connecticut and Massachusetts). Additionally, surcharges are allowed only on credit card payments—not debit cards. Card networks like Visa and Mastercard also have specific rules that businesses must follow, such as notifying the card network and acquirer in advance, disclosing the surcharge amount, and clearly displaying the charge at the point of sale. The Key Differences: A Quick Guide

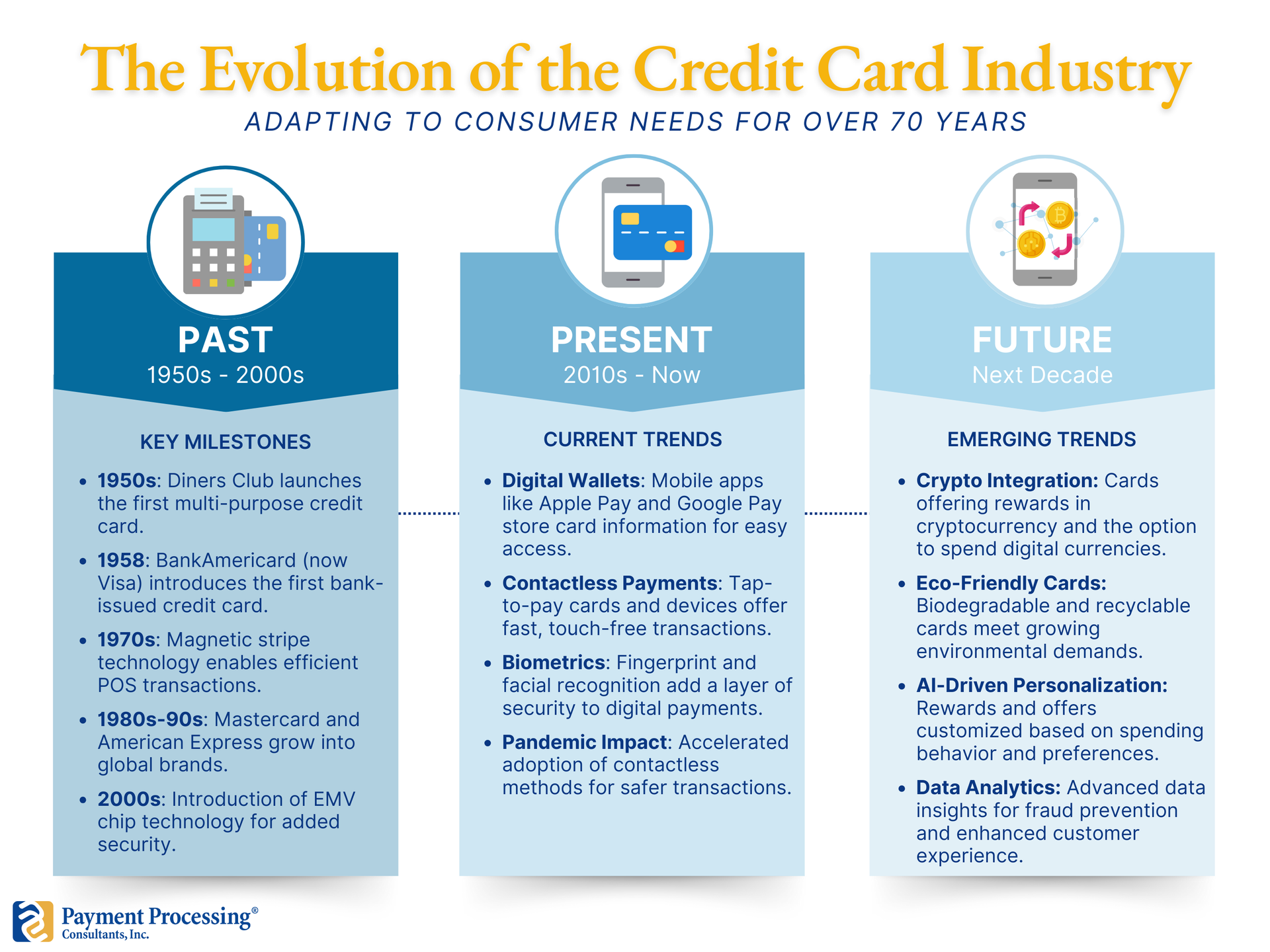

The credit card industry has come a long way since its inception, evolving from a simple concept of deferred payments to a sophisticated system embedded with digital features, global reach, and advanced fraud protection. With rapid technological advancements, changing consumer preferences, and regulatory challenges, the future of the credit card industry presents both exciting opportunities and critical challenges. This article will explore the evolution of the credit card industry, key trends shaping its future, and the challenges that industry players will face in the coming years. The Evolution of the Credit Card Industry 1. Early Beginnings The credit card industry traces its roots back to the early 20th century, when various retail stores began offering credit to trusted customers. In 1950, the Diners Club introduced the first multi-purpose charge card, which allowed holders to pay at a variety of restaurants and stores, laying the groundwork for modern credit cards. The innovation caught on, leading to the launch of the first bank-issued credit card, BankAmericard, in 1958. This card would eventually evolve into Visa, one of the world’s leading payment networks. The credit card revolution expanded globally, and by the 1980s, major players such as Mastercard and American Express became household names. 2. The Digital Shift The digital revolution of the late 20th century transformed credit cards into tools that could be used virtually anywhere in the world. The development of electronic payment networks enabled the shift from paper-based to electronic transactions. This era saw the launch of magnetic stripe technology, enabling more efficient and secure transactions at point-of-sale (POS) terminals. By the 2000s, chip technology (EMV) was introduced, further enhancing security and reducing fraud. 3. The Rise of Mobile and Contactless Payments In the last decade, credit cards have adapted to the rise of digital wallets and contactless payment methods. Consumers can now store credit card information on mobile devices through apps like Apple Pay, Google Pay, and Samsung Pay, making transactions quick and seamless. The COVID-19 pandemic accelerated the adoption of contactless payments, with people seeking safer, touch-free options. This shift has given rise to new payment technologies, including biometrics and QR codes, which are further redefining the credit card experience. Trends Shaping the Future of the Credit Card Industry As the industry continues to evolve, several key trends are shaping its future: 1. Digital-First Credit Cards and Virtual Accounts Digital-first credit cards are designed for online and mobile-first usage, often with physical cards as an optional feature. These cards appeal to tech-savvy consumers who prioritize convenience and security. Virtual accounts, which generate temporary credit card numbers for one-time use, are also becoming popular for online transactions. With digital-first options, consumers benefit from instant access, flexible payment options, and an added layer of security against fraud. 2. Embedded Finance and Open Banking Embedded finance integrates financial services directly into non-financial platforms, enabling consumers to access credit card features directly within apps they frequently use, such as e-commerce or social media. Open banking, which allows third-party financial service providers to access consumer banking data (with permission), enhances this by providing more personalized credit options. Together, embedded finance and open banking are enabling a frictionless customer experience, where credit is more accessible and tailored to individual needs. 3. Personalized Rewards and Loyalty Programs The future of loyalty programs is personalization. With the help of AI and data analytics, credit card issuers can now create rewards programs tailored to individual spending patterns. This shift from generalized points to more meaningful, customer-specific rewards is helping brands build stronger customer loyalty. For instance, a frequent traveler might receive enhanced rewards for flights and hotels, while someone who shops at local retailers might receive exclusive discounts and cashback options at those stores. 4. Advanced Fraud Detection and Prevention Fraud detection and prevention are becoming increasingly sophisticated with advancements in machine learning and artificial intelligence. Modern fraud systems analyze vast amounts of transaction data in real time, identifying unusual patterns and flagging suspicious activity. This proactive approach helps protect cardholders from unauthorized charges and boosts overall confidence in credit card use. As fraud techniques continue to evolve, so too will the technology used to combat it. 5. Environmental and Social Responsibility Initiatives Consumers are increasingly prioritizing brands that align with their values, and the credit card industry is responding. More issuers are launching eco-friendly cards, supporting reforestation, and investing in carbon offset programs. Some credit cards now feature rewards linked to sustainable purchasing or donations to social causes. By adopting environmentally and socially conscious practices, the industry is enhancing its appeal to the growing demographic of ethically-minded consumers. 6. Cryptocurrency Integration With the rise of digital currencies, credit card issuers are beginning to incorporate cryptocurrency features. Some credit cards offer rewards in Bitcoin or other cryptocurrencies, while others allow cardholders to spend crypto at traditional merchants. As digital currencies gain popularity, credit card companies are likely to introduce more crypto-compatible features, creating a bridge between traditional finance and the digital asset economy. Challenges Facing the Credit Card Industry Despite these trends, the industry faces several challenges that could impact its growth: 1. Regulatory Scrutiny and Compliance With increased data access and the integration of third-party services, regulators are tightening standards around data privacy and security. Compliance with regulations like the EU’s General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) requires ongoing investment in data security. Additionally, regulatory agencies are implementing stricter standards around credit risk, cross-border transactions, and fraud detection, posing challenges for issuers seeking to innovate quickly while staying compliant. 2. Competition from Fintech and Alternative Payment Methods The credit card industry is facing fierce competition from fintech solutions that offer direct, consumer-friendly payment options like buy now, pay later (BNPL) services and digital wallets. These alternatives provide flexible payment terms and often lower fees, attracting consumers who are wary of interest charges and fees associated with traditional credit cards. Credit card companies will need to innovate and offer comparable flexibility and value to remain competitive. 3. Rising Cybersecurity Threats As cybercriminals become more sophisticated, protecting sensitive credit card data is a growing challenge. Data breaches can have devastating impacts on both customers and credit card issuers, leading to financial losses, reputational damage, and regulatory penalties. The industry must continuously invest in state-of-the-art cybersecurity measures and customer education to mitigate the risk of data breaches and fraud. 4. Adapting to Changing Consumer Preferences Consumer expectations around convenience, transparency, and ethical responsibility are reshaping how people view credit cards. Younger generations, in particular, are wary of traditional credit models that come with high fees and interest rates. Instead, they are drawn to options that offer flexibility, transparency, and align with their values. The credit card industry must adapt by offering more customer-centric options, such as interest-free installment plans, fee transparency, and eco-friendly practices. 5. Economic Uncertainty and Credit Risk Economic downturns can impact credit card issuers’ revenue, as consumers reduce spending and become more cautious with credit. Furthermore, during recessions, delinquency rates on credit card balances often rise, increasing credit risk for issuers. The credit card industry must therefore balance growth initiatives with sound risk management strategies to safeguard against economic fluctuations. The Future of the Credit Card Industry The credit card industry’s future is likely to be defined by a blend of technological innovation, regulatory adaptation, and customer-centric strategies. To thrive, industry players must embrace flexibility, prioritize customer preferences, and ensure security. Here are a few predictions: Real-Time Data and AI-Powered Personalization: Credit card companies will increasingly leverage real-time data analytics to provide ultra-personalized offerings that reflect each customer’s lifestyle and spending habits. Expansion of Credit Ecosystems: The integration of credit services within broader ecosystems, such as digital wallets and e-commerce platforms, will offer customers more seamless access to credit, anytime and anywhere. Focus on Sustainability: As environmental concerns continue to grow, credit card companies may further develop eco-conscious products, such as biodegradable cards or rewards that incentivize sustainable spending. Collaboration with Fintechs: Rather than compete, credit card issuers may increasingly partner with fintech companies to leverage each other’s strengths, such as embedding credit services within BNPL apps or offering cryptocurrency options. As the industry evolves, credit card providers that proactively adapt to these trends, address challenges, and prioritize customer needs will continue to succeed in an ever-competitive landscape. The next decade promises a transformative journey for the credit card industry as it becomes more digital, data-driven, and responsive to the needs of a new generation of consumers.

Payment gateways are an essential component of modern e-commerce, enabling businesses to accept online payments securely and efficiently. In this article, we will provide an in-depth overview of payment gateways, including how they work, examples of popular payment gateways, and tips for businesses to choose the right payment gateway for their needs. What Are Payment Gateways? Payment gateways are software applications that facilitate the secure transfer of funds between a customer's bank account or credit card and a merchant's bank account. When a customer makes a purchase online, the payment gateway encrypts the transaction details and sends them to the payment processor, which verifies the transaction and transfers the funds to the merchant's bank account. How Do Payment Gateways Work? Payment gateways work by integrating with a merchant's e-commerce platform, such as a website or mobile app. When a customer makes a purchase, they are directed to a payment page hosted by the payment gateway, where they enter their payment information. The payment gateway then encrypts the information and sends it to the payment processor, which processes the transaction and sends a response back to the payment gateway. The payment gateway then communicates the transaction status to the merchant's e-commerce platform, allowing the merchant to fulfill the order. There are many payment gateways available, each with their own features, pricing models, and integrations. When choosing a payment gateway, businesses should consider several factors, including: Fees - Payment gateway fees can vary widely, and businesses should choose a gateway that offers competitive rates and transparent pricing models. Security - Payment gateways should offer robust security features, including encryption and fraud prevention tools, to protect both the business and its customers. Integrations - Payment gateways should integrate seamlessly with the business's e-commerce platform, allowing for efficient payment processing and order fulfillment. Support - Payment gateways should provide excellent customer support, with timely responses to inquiries and assistance with technical issues. Whether you're looking for competitive pricing, top-notch security, seamless integrations, or outstanding customer support, we're here to assist you every step of the way. Feel free to contact us for guidance and start optimizing your payment processing system to enhance your online business.

As a sales agent in the credit card processing industry, prospecting is vital to your job. Prospecting involves identifying and qualifying potential customers interested in your products or services. With effective prospecting techniques, you can expand your customer base, increase your sales, and substantially grow your business. In this article, we'll delve into tips and techniques tailored to empower you, the sales agent, to excel in credit card processing prospecting. Identify Your Target Market Before you start prospecting, it's essential to identify your target market. Who are the businesses that would benefit the most from your services? Traditionally, any business that accepts credit card payments is a potential prospect. However, your efforts may yield more results when concentrated on specific sectors, such as retail establishments, restaurants, or e-commerce entities, where the demand for services may be more pronounced. Identifying your target market allows you to channel your efforts toward businesses most likely to convert into loyal customers. Use Social Media Social media is a powerful tool for prospecting. LinkedIn, in particular, can be an excellent platform for connecting with potential customers in the credit card processing industry. You can use LinkedIn to identify businesses in your target market and engage directly with decision-makers. Furthermore, consider joining industry-specific groups where you can stay on top of industry developments and proactively interact with prospective clients by sharing pertinent news and insightful content. Attend Networking Events Engaging in networking events is yet another avenue for effective prospecting. Look for events that are attended by your target market, such as trade shows or industry conferences. These events allow you to connect with potential customers face-to-face, build relationships, and demonstrate your expertise. Leverage Referrals Referrals are an excellent source of new business in the industry. You can start by contacting your existing customers and asking if they know of other companies that could benefit from your services. You can also encourage referrals by introducing incentives, such as discounts or rewards, fostering a relationship that benefits your customers and your business. Use Email Marketing Create an email list of businesses in your target market and send out regular emails with information about your services and any promotions or special offers. Ensure that each email concludes with a clear and compelling call to action, inviting recipients to engage in consultations or further discussions. Offer Free Comparisons We highly recommend that sales agents in the credit card processing industry offer a free cost comparison to potential customers. This service can be a game-changer in attracting and converting leads. By providing a detailed cost analysis, you demonstrate transparency and showcase the potential savings and benefits your services can offer. It allows businesses to see a tangible return on investment, making it a compelling reason to choose your services over competitors. Moreover, a free cost comparison positions you as a trusted advisor, committed to helping businesses make informed financial decisions. It's a proactive approach that can set you apart in a competitive market and significantly increase your chances of winning new clients.

In the ever-evolving landscape of the financial industry, selling credit card processing services has emerged as a substantial and lucrative opportunity for sales professionals. This article explores why this niche sector has garnered such attention and outlines the key factors that make it an attractive arena for those looking to excel in sales. The Growth of Digital Payments The digital revolution has brought about a profound transformation in how we conduct financial transactions. Gone are the days of primarily relying on physical cash or checks; today, we live in an era where electronic commerce (e-commerce), mobile payments, and contactless technology have become the norm. These advancements have significantly increased our dependence on credit card processing services. To put this into perspective, consider the insights presented in a report by Statista: the global digital payments market was valued at a staggering $4.1 trillion in 2020, and it's anticipated to surge to nearly $8 trillion by 2024. This surge in digital payments has not only revolutionized the way we pay but has also presented a vast and lucrative market for credit card processing services. At the heart of this transformation is the e-commerce revolution. With the advent of the internet, consumers can now effortlessly shop for products and services online, often using credit cards to facilitate these transactions. This shift towards online shopping has intensified the reliance on digital payment methods. When a consumer buys something on the internet, it's the efficient processing of credit card payments that ensures the swift and secure transfer of funds from the buyer to the seller. Small and Medium-Sized Businesses (SMBs) The immense opportunity in selling credit card processing services stems from the vast pool of small and medium-sized businesses (SMBs). SMBs are the backbone of the global economy, yet many lack access to efficient and affordable payment solutions needed to thrive in the digital era. These businesses operate with limited resources compared to larger corporations, making them eager for payment solutions that streamline operations and boost competitiveness in the digital age. Sales professionals can fill this crucial gap by offering tailored credit card processing solutions designed specifically for SMBs. These solutions encompass various services, from point-of-sale systems to mobile payment options and e-commerce gateways. Sales agents are trusted advisors who understand SMBs' payment needs and can recommend and implement the most suitable solutions. In essence, selling credit card processing services bridges the technology gap for SMBs, empowering them to thrive in an evolving digital landscape. This opportunity enables sales professionals to build mutually beneficial relationships, contribute to SMB growth, and capture a substantial market share brimming with potential. Residual Income Potential Credit card processing services provide sales professionals with a distinct financial benefit: residual income. Unlike conventional sales positions, where commissions are typically one-time payments, selling credit card processing services offers the potential for ongoing income. Agents earn a percentage of the transaction fees generated by the merchants they bring on board. This means that as these businesses grow and conduct more transactions, agents continue to earn. This model fosters strong, long-term client relationships as agents are motivated to support their clients' growth. Over time, the cumulative effect of residual income can be substantial, providing financial stability and opportunities for further investment. This feature not only ensures immediate rewards for sales efforts but also lays the foundation for a reliable and sustainable income stream, making the credit card processing industry an enticing opportunity for sales professionals. Competitive Edge With the increased demand for payment processing solutions, a multitude of companies are vying for a share of the market. Sales professionals who establish themselves in this field can gain a competitive edge. By becoming experts in the nuances of credit card processing, they position themselves as trusted advisors who can guide businesses toward the best payment solutions. This expertise can be a powerful selling point. Value-Added Services Beyond the basic processing of credit card payments, many service providers offer a range of value-added services. These can include fraud prevention tools, analytics, reporting, and integration with other business software. Sales professionals can leverage these additional services to create tailored packages that meet the specific needs of their clients, thereby enhancing their value proposition. Statistical Evidence Statistics reinforce the notion that selling credit card processing services represents a significant opportunity. According to the Nilson Report, global card fraud losses reached $27.85 billion in 2018, underscoring the need for advanced fraud prevention solutions – an area where credit card processing services can make a substantial impact. Moreover, the Small Business Administration (SBA) reports that there are over 31 million small businesses in the United States alone, representing a vast market for payment processing services. Selling credit card processing services is not just about capitalizing on a growing market; it's about offering businesses the tools they need to thrive in the digital age. With the potential for substantial residual income, a vast SMB market, and the opportunity to provide value-added services, it's no wonder that credit card processing represents such a big opportunity for sales professionals. Those who enter this field armed with knowledge, dedication, and a commitment to helping businesses succeed can find both financial success and professional fulfillment.

Bitcoin, a decentralized digital currency, has been making waves in the financial world since its inception in 2009. As it becomes more widely accepted as a form of payment, questions arise about its relationship with the credit card industry. In this article, we will explore the relationship between Bitcoin and the credit card industry, as well as consumer perspectives on this evolving landscape. Bitcoin vs. Credit Cards: What's the Difference? Bitcoin and credit cards are fundamentally different in how they operate. Credit cards are issued by financial institutions and allow consumers to borrow money for purchases. The transaction is then recorded on the credit card statement, and the consumer pays back the debt with interest. On the other hand, Bitcoin is a decentralized digital currency that operates on a blockchain ledger, allowing for peer-to-peer transactions without the need for a middleman. Bitcoin's Impact on the Credit Card Industry Bitcoin has the potential to disrupt the credit card industry by offering a more secure and efficient payment method. With credit cards, consumers must entrust their personal and financial information to financial institutions and third-party payment processors. This can leave them vulnerable to data breaches and identity theft. Bitcoin transactions, on the other hand, do not require the disclosure of personal information, making them more secure. Bitcoin also offers faster transaction processing times and lower transaction fees than credit cards. This is because Bitcoin transactions are processed on a decentralized network, rather than a centralized payment processor. As a result, merchants can save money on transaction fees, and consumers can enjoy faster and cheaper transactions. Consumer Perspectives on Bitcoin and Credit Cards Consumers have mixed perspectives on the relationship between Bitcoin and credit cards. Some see Bitcoin as a more secure and efficient payment method that could eventually replace credit cards. Others are hesitant to adopt Bitcoin due to its volatility and lack of mainstream acceptance. According to a survey conducted by Finder in 2021, 17.1% of American adults had invested in Bitcoin, while 44.3% had no interest in investing in Bitcoin. Of those who had invested in Bitcoin, 47.5% cited the potential for high returns as the primary reason for investing. However, 35.9% of those surveyed cited the high volatility of Bitcoin as a reason for not investing. In terms of using Bitcoin as a form of payment, the same Finder survey found that only 9.4% of respondents had used Bitcoin to make a purchase in the past year. This is likely due to the limited number of merchants that accept Bitcoin as payment, as well as concerns about its volatility. Bitcoin and the credit card industry are two very different payment methods with unique advantages and disadvantages. While Bitcoin has the potential to disrupt the credit card industry, consumer adoption and mainstream acceptance remain obstacles. As the financial landscape continues to evolve, it will be interesting to see how the relationship between Bitcoin and the credit card industry develops and how consumers respond.

As a sales agent in the dynamic world of credit card processing, you know that generating new business requires a multi-faceted approach. Among these strategies, one stands out as both potent and proven: leveraging referrals. Referrals are like gold in the sales world – they come with built-in trust and a higher probability of converting into a successful deal. According to an enlightening study by the New York Times, a substantial 65% of new business emerges from referrals. Let's delve into the depths of how sales agents in the credit card processing industry can harness the potential of referral sources to create a flourishing pipeline of new opportunities… Step 1: Identify Your Referral Sources Before you set your referral strategy in motion, you need to identify your prime sources. Your referral treasure trove comprises individuals and entities with connections to your target market. Think about existing satisfied clients, industry allies, vendors, and even your personal circle. Step 2: Nurture Relationships with Care Now that you've mapped out your referral sources, the next step is to nurture these relationships. Genuine connections often become the wellspring of valuable referrals. Regularly engage with your sources by sharing industry updates, insights, and even offering assistance for their own business needs. Step 3: Incentivize the Referral Engine Incentives can ignite your referral engine like nothing else. Consider creating a system where referring your services comes with rewards. These can range from service discounts to enticing gift cards or even direct cash bonuses. Keep your incentive program simple and transparent, and keep your referral sources in the loop. Step 4: Provide Outstanding Service Ultimately, your reputation and the quality of your service will determine the success of your referral strategy. Happy customers are the best advertisers. If your existing clients are pleased with your services, they are more likely to sing your praises to their network. Going above and beyond to meet their needs will not only keep them loyal but also encourage them to refer your services. Step 5: Simplify the Referral Process Your referral sources are doing you a favor, so make it as effortless as possible for them to refer your services. Equip them with marketing materials or referral cards that they can hand out. In this digital age, consider implementing an online or mobile app-based referral program to make the process seamless. Step 6: Swift Follow-Ups Make the Difference When a referral comes your way, prompt action is essential. The longer you delay, the lower the chances of conversion. Respond swiftly, demonstrate your dedication, and provide exceptional service throughout the sales journey. In essence, tapping into referral sources holds the key to exponential growth for sales agents in the credit card processing industry. By identifying sources, nurturing relationships, incentivizing referrals, providing top-notch service, simplifying the referral process, and ensuring quick follow-ups, you can build a robust referral network that becomes your secret weapon for success. With consistent effort and a strategic approach, you can elevate your sales game to new heights, opening doors to unexplored avenues of growth. Referrals aren't just leads; they are the bridge to lasting prosperity.

Credit card fraud is an escalating concern for businesses of all sizes. According to a recent report by the Nilson Report, global card fraud losses reached a staggering $27.85 billion in 2018 and continue to surge. As dedicated professionals within the credit card processing industry, it is our duty to assist clients in shielding themselves from fraud and mitigating financial risks. Below, we present a comprehensive set of strategies to help businesses safeguard their interests: 1. Embrace EMV Technology: The Power of EMV: EMV chip technology stands as a formidable weapon against credit card fraud. Its ability to authenticate cards and secure transactions significantly reduces the risk of counterfeit fraud. Example: Picture a small boutique clothing store that recently adopted EMV-enabled credit card terminals. When a customer attempts to use a counterfeit credit card, the EMV technology instantly flags it as fraudulent, thus preventing potential losses. Without EMV technology, the store would have remained vulnerable to financial harm. 2. Employee Training: The Role of Employee Training: Employees act as the initial line of defense against fraud. Therefore, it is crucial for businesses to provide comprehensive training on recognizing suspicious transactions and responding appropriately. Example: Suppose a restaurant owner's staff notices a customer using multiple credit cards for a single purchase. Suspecting irregularities, they promptly verify the customer's identification and contact the credit card issuer to confirm the transaction's legitimacy. Their training in fraud prevention techniques prevents the fraudulent transaction from succeeding. 3. Transaction Monitoring: Vigilant Transaction Oversight: Encourage clients to diligently monitor their credit card transactions for unusual patterns. These might include multiple transactions from the same card in a short time frame or purchases that deviate from a customer's typical spending habits. Example: Imagine a small convenience store grappling with an unexpected surge in chargebacks, primarily linked to customers from a specific day. By identifying this pattern of fraud, the store takes swift action to mitigate further losses. 4. Implement Fraud Prevention Software: Leveraging Technology: Numerous software tools are available to help businesses detect and prevent credit card fraud. These tools employ advanced algorithms and machine learning to analyze transactions in real time and identify potential fraud. Example: Consider an online retailer experiencing a high volume of chargebacks. By utilizing a fraud prevention tool, the online store detects fraudulent transaction patterns and intervenes before these transactions can materialize. This proactive approach not only preserves financial resources but also safeguards merchandise from loss due to fraudulent activities. 5. Stay Informed on Emerging Trends: Adapt and Evolve: Credit card fraudsters perpetually refine their tactics. Clients should be encouraged to stay informed about the latest trends in fraud and adjust their prevention strategies accordingly. Example: Let's take the case of a hotel that detects a rise in fraudulent reservations. By actively monitoring evolving fraud trends, the hotel identifies new patterns and takes preventive measures, protecting its financial stability and the safety of its guests. In conclusion, credit card fraud poses a significant threat to businesses across all sectors. As professionals within the credit card processing industry, it is incumbent upon us to guide our clients in fortifying their defenses and mitigating the risk of financial losses. Through the adoption of EMV-enabled credit card terminals, comprehensive employee training, vigilant transaction monitoring, the integration of fraud prevention software, and staying attuned to evolving fraud trends, our clients can substantially enhance their ability to protect their businesses and customers from the perils of credit card fraud.

The credit card industry is continually evolving, shaped by technological advancements, shifting consumer preferences, and global economic factors. To thrive in this dynamic landscape, businesses must stay informed about the latest trends that are influencing the credit card industry. In this article, we explore the most noteworthy developments in the credit card sector and their implications for businesses. 1. Contactless Payments Are King: One of the most significant shifts in the credit card industry is the rise of contactless payments. Accelerated by the global pandemic, consumers now prefer touchless transactions for their convenience and safety. Contactless payments, which include mobile wallet options like Apple Pay and Google Pay, have become the norm. Businesses that adopt contactless payment solutions not only meet customer expectations but also benefit from faster and more secure transactions. 2. Enhanced Security Measures: As contactless payments become prevalent, security remains a top priority. Credit card companies are continually investing in advanced security features. The adoption of EMV chip technology, tokenization, and biometric authentication methods, such as fingerprint and facial recognition, are all aimed at safeguarding transactions. Businesses must align with these security measures to protect their customers' data and maintain trust. 3. Digital-First Banking: Digital banking and neo-banking have disrupted traditional financial institutions. These fintech companies offer streamlined and user-friendly services, often providing credit cards as part of their offerings. The ease of application, minimal fees, and competitive rewards programs of these digital-first credit cards have made them appealing to consumers. Traditional banks and credit card issuers must adapt by offering seamless digital experiences to remain competitive. 4. Personalization and Rewards: Credit card companies are focusing on personalization to attract and retain customers. They analyze spending patterns and offer tailored rewards and discounts based on individual preferences. This trend emphasizes the importance of businesses collaborating with credit card companies to create co-branded cards that provide exclusive offers to cardholders. Such partnerships can boost customer loyalty and drive sales. 5. Sustainability and Eco-Friendly Initiatives: Consumers are increasingly eco-conscious, and this trend is influencing credit card choices. Many credit card issuers now offer environmentally friendly cards that support sustainability initiatives. These cards may contribute to reforestation efforts, carbon offset programs, or other green causes. Businesses aligned with eco-friendly values can leverage such cards to appeal to environmentally conscious consumers. 6. Buy Now, Pay Later (BNPL) Services: Buy Now, Pay Later services have gained traction, particularly among younger consumers. These services allow shoppers to make purchases and pay for them in installments, often with no interest. The flexibility of BNPL options appeals to those who want to manage their finances more effectively. Integrating BNPL into e-commerce platforms can help businesses cater to this growing segment of shoppers. 7. Regulatory Changes: Regulations in the credit card industry are continually evolving, impacting both card issuers and businesses. Compliance with data security standards, such as the Payment Card Industry Data Security Standard (PCI DSS), remains paramount. Additionally, businesses need to stay updated on changes in interchange fees, disclosure requirements, and other regulatory developments that may affect credit card acceptance. Staying on top of credit card industry trends is crucial for businesses aiming to remain competitive and customer-centric. Adapting to the shift towards contactless payments, prioritizing security, embracing digital-first banking, offering personalized rewards, supporting sustainability, integrating BNPL services, and monitoring regulatory changes are key strategies for businesses to navigate the ever-evolving credit card landscape successfully. By doing so, businesses can position themselves to meet customer demands and seize opportunities for growth in this dynamic industry.