In the ever-evolving landscape of the financial industry, selling credit card processing services has emerged as a substantial and lucrative opportunity for sales professionals. This article explores why this niche sector has garnered such attention and outlines the key factors that make it an attractive arena for those looking to excel in sales.

The Growth of Digital Payments

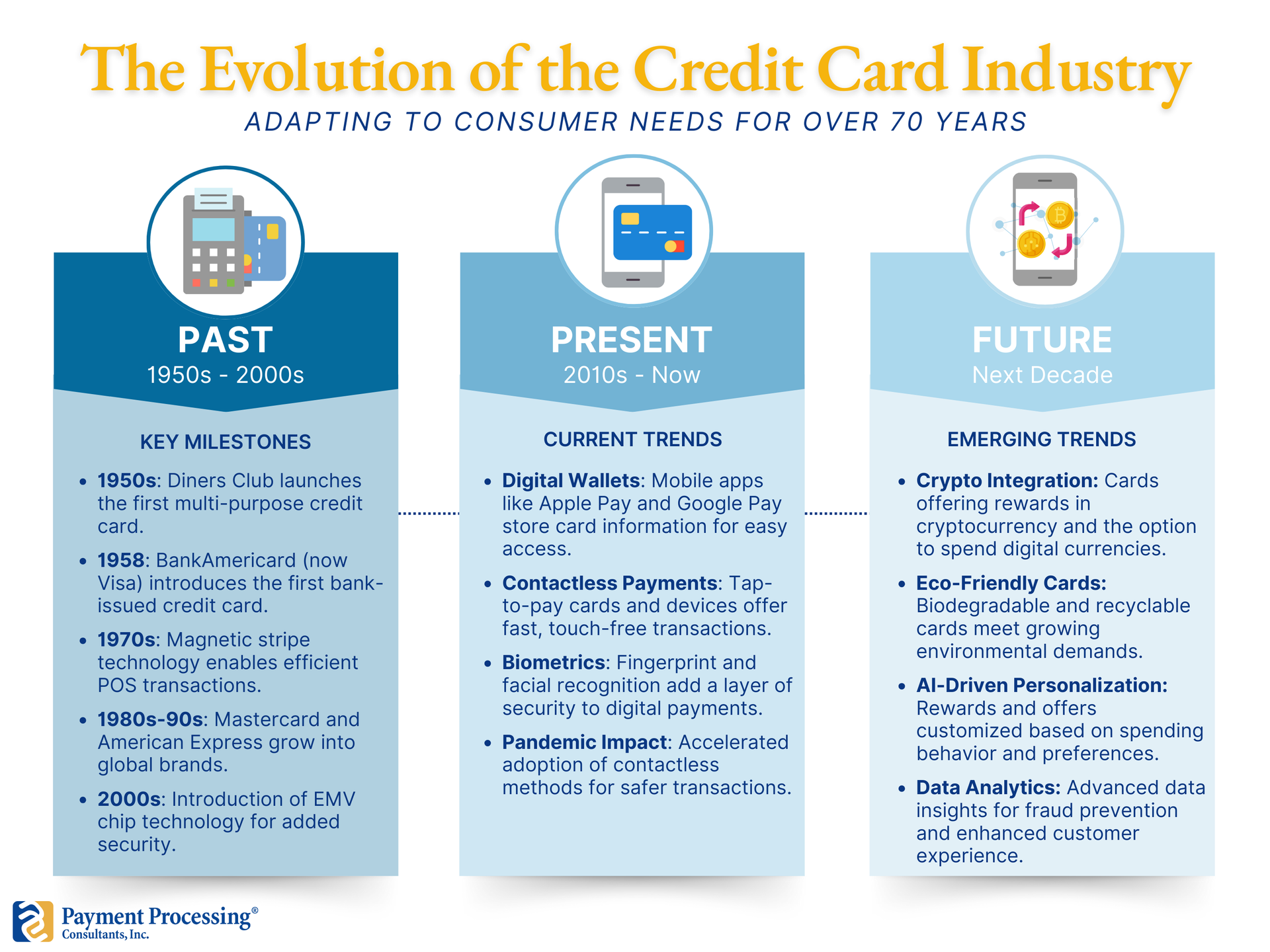

The digital revolution has brought about a profound transformation in how we conduct financial transactions. Gone are the days of primarily relying on physical cash or checks; today, we live in an era where electronic commerce (e-commerce), mobile payments, and contactless technology have become the norm. These advancements have significantly increased our dependence on credit card processing services. To put this into perspective, consider the insights presented in a report by Statista: the global digital payments market was valued at a staggering $4.1 trillion in 2020, and it's anticipated to surge to nearly $8 trillion by 2024. This surge in digital payments has not only revolutionized the way we pay but has also presented a vast and lucrative market for credit card processing services.

At the heart of this transformation is the e-commerce revolution. With the advent of the internet, consumers can now effortlessly shop for products and services online, often using credit cards to facilitate these transactions. This shift towards online shopping has intensified the reliance on digital payment methods. When a consumer buys something on the internet, it's the efficient processing of credit card payments that ensures the swift and secure transfer of funds from the buyer to the seller.

Small and Medium-Sized Businesses (SMBs)

The immense opportunity in selling credit card processing services stems from the vast pool of small and medium-sized businesses (SMBs). SMBs are the backbone of the global economy, yet many lack access to efficient and affordable payment solutions needed to thrive in the digital era.

These businesses operate with limited resources compared to larger corporations, making them eager for payment solutions that streamline operations and boost competitiveness in the digital age. Sales professionals can fill this crucial gap by offering tailored credit card processing solutions designed specifically for SMBs.

These solutions encompass various services, from point-of-sale systems to mobile payment options and e-commerce gateways. Sales agents are trusted advisors who understand SMBs' payment needs and can recommend and implement the most suitable solutions.

In essence, selling credit card processing services bridges the technology gap for SMBs, empowering them to thrive in an evolving digital landscape. This opportunity enables sales professionals to build mutually beneficial relationships, contribute to SMB growth, and capture a substantial market share brimming with potential.

Residual Income Potential

Credit card processing services provide sales professionals with a distinct financial benefit: residual income. Unlike conventional sales positions, where commissions are typically one-time payments, selling credit card processing services offers the potential for ongoing income. Agents earn a percentage of the transaction fees generated by the merchants they bring on board. This means that as these businesses grow and conduct more transactions, agents continue to earn. This model fosters strong, long-term client relationships as agents are motivated to support their clients' growth. Over time, the cumulative effect of residual income can be substantial, providing financial stability and opportunities for further investment. This feature not only ensures immediate rewards for sales efforts but also lays the foundation for a reliable and sustainable income stream, making the credit card processing industry an enticing opportunity for sales professionals.

Competitive Edge

With the increased demand for payment processing solutions, a multitude of companies are vying for a share of the market. Sales professionals who establish themselves in this field can gain a competitive edge. By becoming experts in the nuances of credit card processing, they position themselves as trusted advisors who can guide businesses toward the best payment solutions. This expertise can be a powerful selling point.

Value-Added Services

Beyond the basic processing of credit card payments, many service providers offer a range of value-added services. These can include fraud prevention tools, analytics, reporting, and integration with other business software. Sales professionals can leverage these additional services to create tailored packages that meet the specific needs of their clients, thereby enhancing their value proposition.

Statistical Evidence

Statistics reinforce the notion that selling credit card processing services represents a significant opportunity. According to the Nilson Report, global card fraud losses reached $27.85 billion in 2018, underscoring the need for advanced fraud prevention solutions – an area where credit card processing services can make a substantial impact. Moreover, the Small Business Administration (SBA) reports that there are over 31 million small businesses in the United States alone, representing a vast market for payment processing services.

Selling credit card processing services is not just about capitalizing on a growing market; it's about offering businesses the tools they need to thrive in the digital age. With the potential for substantial residual income, a vast SMB market, and the opportunity to provide value-added services, it's no wonder that credit card processing represents such a big opportunity for sales professionals. Those who enter this field armed with knowledge, dedication, and a commitment to helping businesses succeed can find both financial success and professional fulfillment.