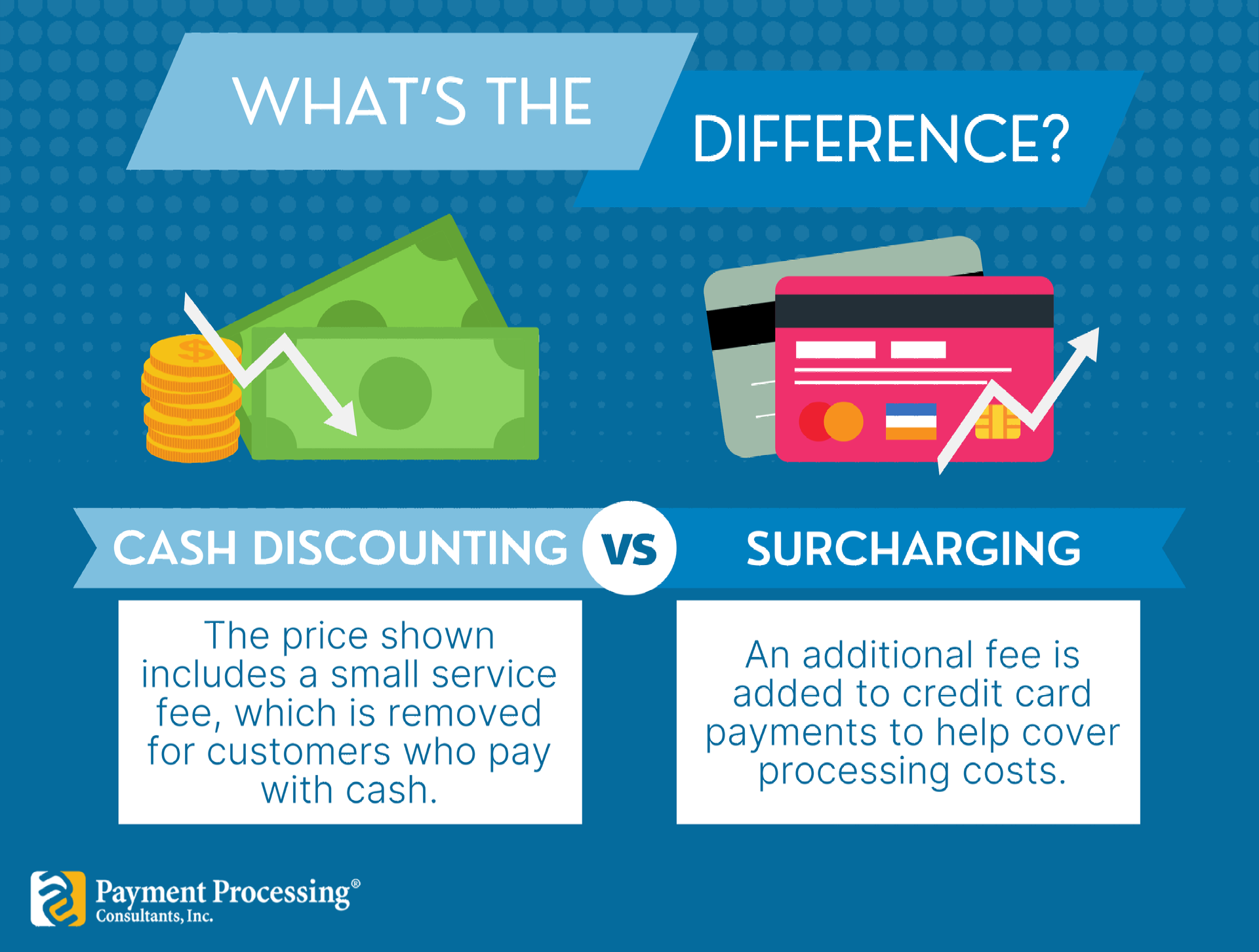

For business owners navigating the complex world of payment processing, understanding the strategies around credit card fees is crucial. Two popular strategies, cash discounting and surcharging, allow businesses to manage processing costs and incentivize payment preferences. Each approach has distinct characteristics, benefits, and legal considerations, so choosing the right one for your business can impact customer satisfaction and operational costs.

This article will break down the differences between cash discounting and surcharging, helping you determine which option best suits your business needs.

What is Cash Discounting?

Cash discounting is a program where a business offers a discount to customers who pay with cash. Rather than adding a fee for credit card payments, it simply provides an incentive for using cash, reducing the overall transaction cost for customers who don’t use credit cards.

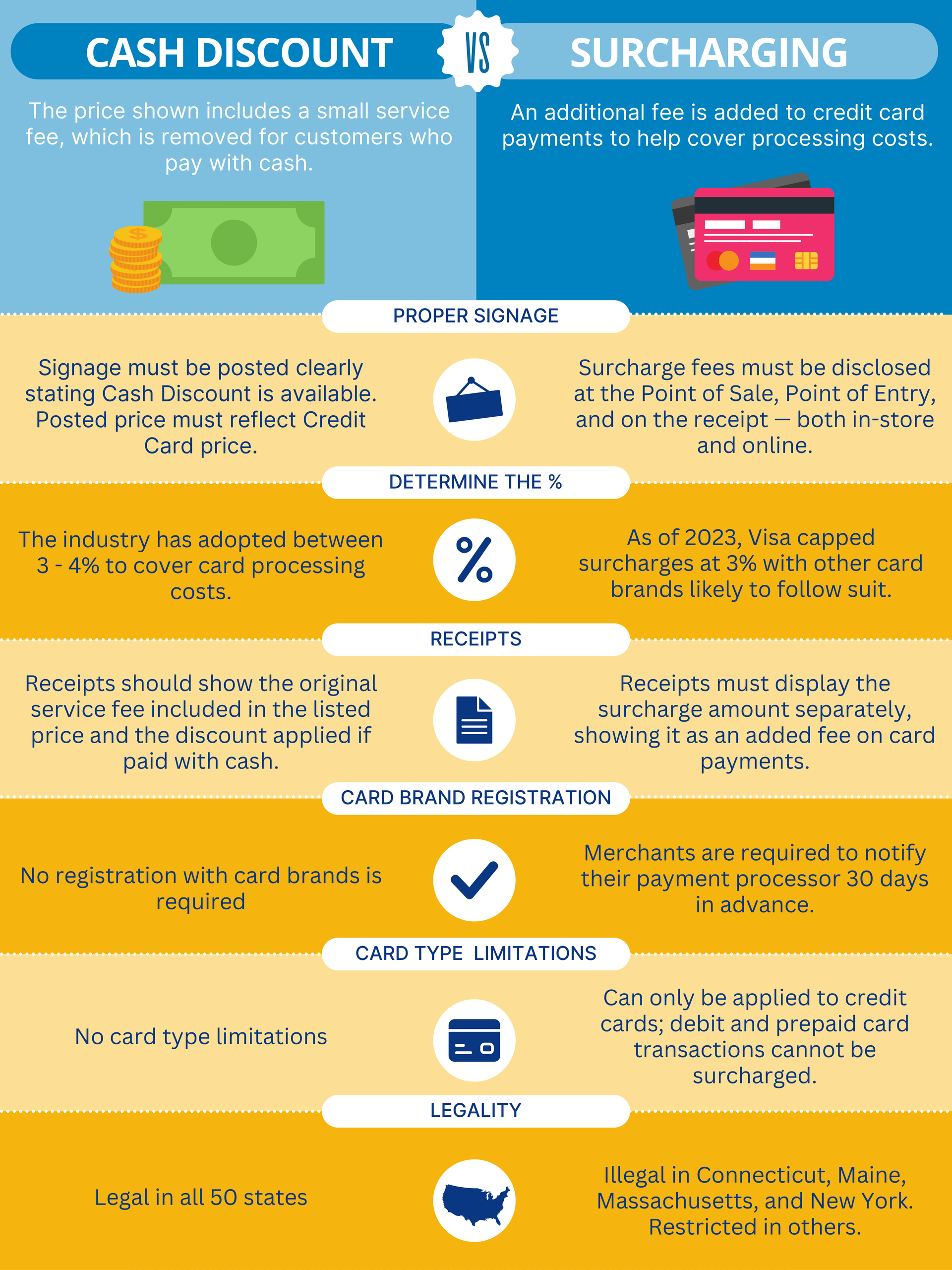

- How it Works: The listed prices reflect the credit card price, and a discount (often 3-4%) is applied when a customer chooses to pay with cash. This discount effectively lowers the price for cash-paying customers while maintaining standard pricing for those using cards.

- Benefits for Businesses: Cash discounting can help reduce processing fees, as more customers may opt to pay with cash to receive the discount. This approach also avoids passing on any additional charges directly to credit card users, which can foster a positive customer experience.

- Customer Perspective: Cash-paying customers enjoy a lower price, which can be an attractive option. Meanwhile, credit card users pay the listed price without feeling an added “penalty” for using their card.

Legal Considerations

Cash discounting is legal in all U.S. states, but it’s essential to comply with federal regulations and the terms set by card networks. Business owners must ensure the advertised price is the credit card price and that the cash discount is clearly displayed at the point of sale.

What is Surcharging?

Surcharging is the practice of adding a fee to the transaction total when a customer pays with a credit card. This fee, usually a percentage of the transaction amount (typically 1-4%), is designed to cover the cost of credit card processing fees, allowing the business to offset these expenses.

- How it Works: The business adds a surcharge fee to the transaction amount if the customer chooses to pay with a credit card, effectively passing the processing cost to the cardholder.

- Benefits for Businesses: Surcharging can directly offset credit card processing fees, which can result in significant savings for businesses that see high volumes of credit card transactions. By shifting the cost to credit card users, businesses can preserve their profit margins.

- Customer Perspective: Customers who pay with credit cards may feel the impact of the added surcharge. While this approach can help cover fees, it may be less appealing to customers who expect to pay the listed price without additional costs.

Legal Considerations

Surcharging is legal in many states but is restricted or banned in some (e.g., Connecticut and Massachusetts). Additionally, surcharges are allowed only on credit card payments—not debit cards. Card networks like Visa and Mastercard also have specific rules that businesses must follow, such as notifying the card network and acquirer in advance, disclosing the surcharge amount, and clearly displaying the charge at the point of sale.

The Key Differences:

A Quick Guide

Choosing the Right Option for Your Business

Both cash discounting and surcharging can help business owners manage processing costs, but each has unique implications:

- Cash Discounting: This option may be ideal if you want to encourage cash payments without making credit card users feel penalized. Cash discounting also provides a legally straightforward solution as it’s accepted nationwide.

- Surcharging: If credit card fees significantly impact your bottom line and your customers are less likely to be deterred by added fees, surcharging may be a good option. However, be mindful of the legal requirements and customer sensitivity to added fees.

Implementing Cash Discounting or Surcharging

- Compliance: Ensure you understand state and federal laws and follow all card network rules. Consulting with a payment processing provider can help ensure your program is compliant.

- Clear Signage: Whether you choose cash discounting or surcharging, provide clear signage at the point of sale. Transparency helps manage customer expectations and builds trust.

- Customer Communication: Educate your staff and customers about the benefits of your program, whether it’s the discount for cash payments or the need to cover credit card processing costs.

- Evaluate Customer Response: Track how customers respond to your program and adjust as needed. Some businesses may find that one method works better than the other based on their specific customer base and transaction types.

Both cash discounting and surcharging offer viable ways to manage credit card processing costs, but the right choice depends on your business type, customer preferences, and regulatory requirements. By understanding the distinctions and carefully implementing a compliant program, business owners can reduce expenses while maintaining a positive customer experience.