WHY

CHOOSE

PPC?

Since 1998, Payment Processing Consultants, Inc. has proudly served Rochester and the surrounding area. We help businesses accept all non-cash forms of payment—so you can grow, improve convenience for your customers, and boost your bottom line. Our mission is to simplify payment processing by eliminating nuisance fees and confusing jargon. With transparent pricing, honest salespeople, and a proven track record of success both locally and nationally, we are committed to delivering on our promise.

WHICH OPTION IS RIGHT FOR YOU?

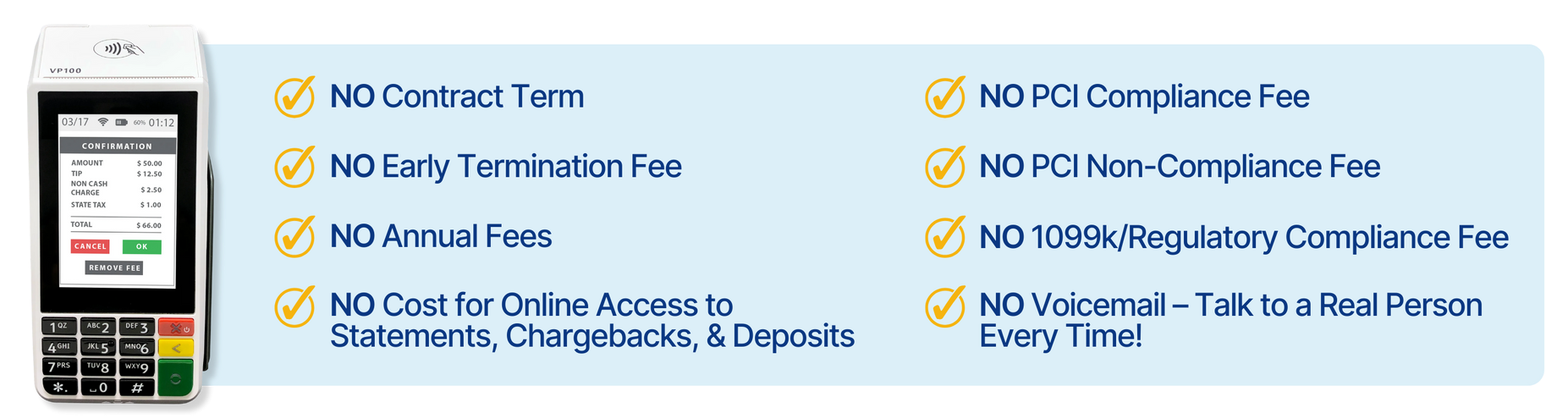

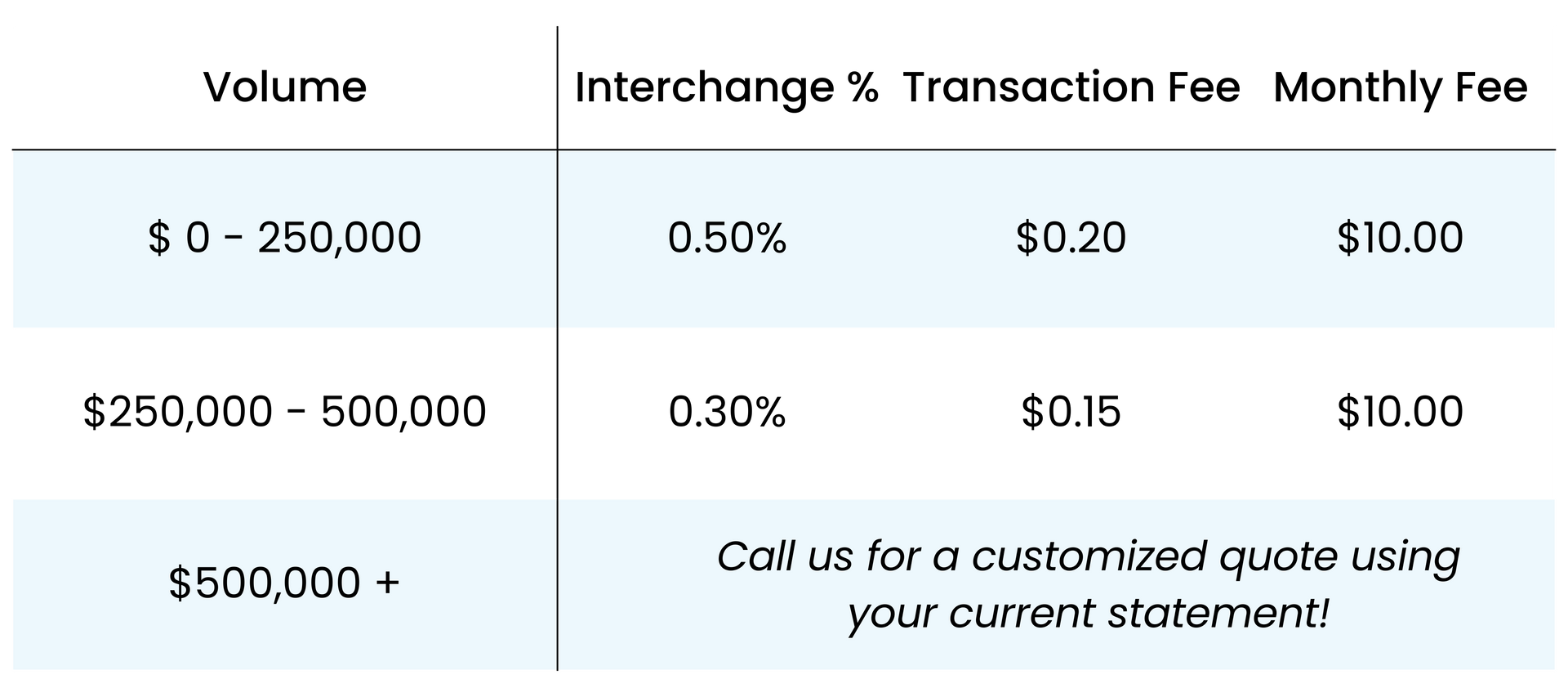

INTERCHANGE PLUS FIXED RATE

Pay the actual interchange fees set by card networks, plus a fixed rate. Transparency and control for your business. Your pricing is dependent on your credit card volume:

ZERO COST PRICING

Eliminate Fees, Keep Accepting Credit Cards. Offset processing costs by passing them to customers as a non-cash adjustment.

Tell us about your business to get started:

Contact Us

YOU ASKED, WE ANSWERED.

When will I receive funds in my bank account from the credit card transactions?

Most merchants receive deposits within 1–2 business days, but we do offer same-day and next-day funding for businesses that qualify. Some industries or higher-risk businesses may have longer funding timelines.

What kind of costs and fees are involved?

Payment processing fees typically fall into three categories:

1. Interchange Fees – Set by card brands (Visa, Mastercard, etc.) and paid to the cardholder’s bank. These vary based on the card type, transaction method, and business type.

2. Assessment Fees – Charged by the card brands themselves, usually a small percentage of each transaction.

3. Interchange Fees – This is our fee for managing your processing account and includes:

- A small percentage or flat per-transaction fee

- Monthly service or statement fees

- PCI compliance fees

- Equipment costs (if needed)

- Incidental fees such as chargebacks or non-compliance

At PPC, we use a transparent interchange-plus pricing model, meaning you only pay the true cost of the card plus a clearly defined markup. No confusing flat rates, and no hidden fees.

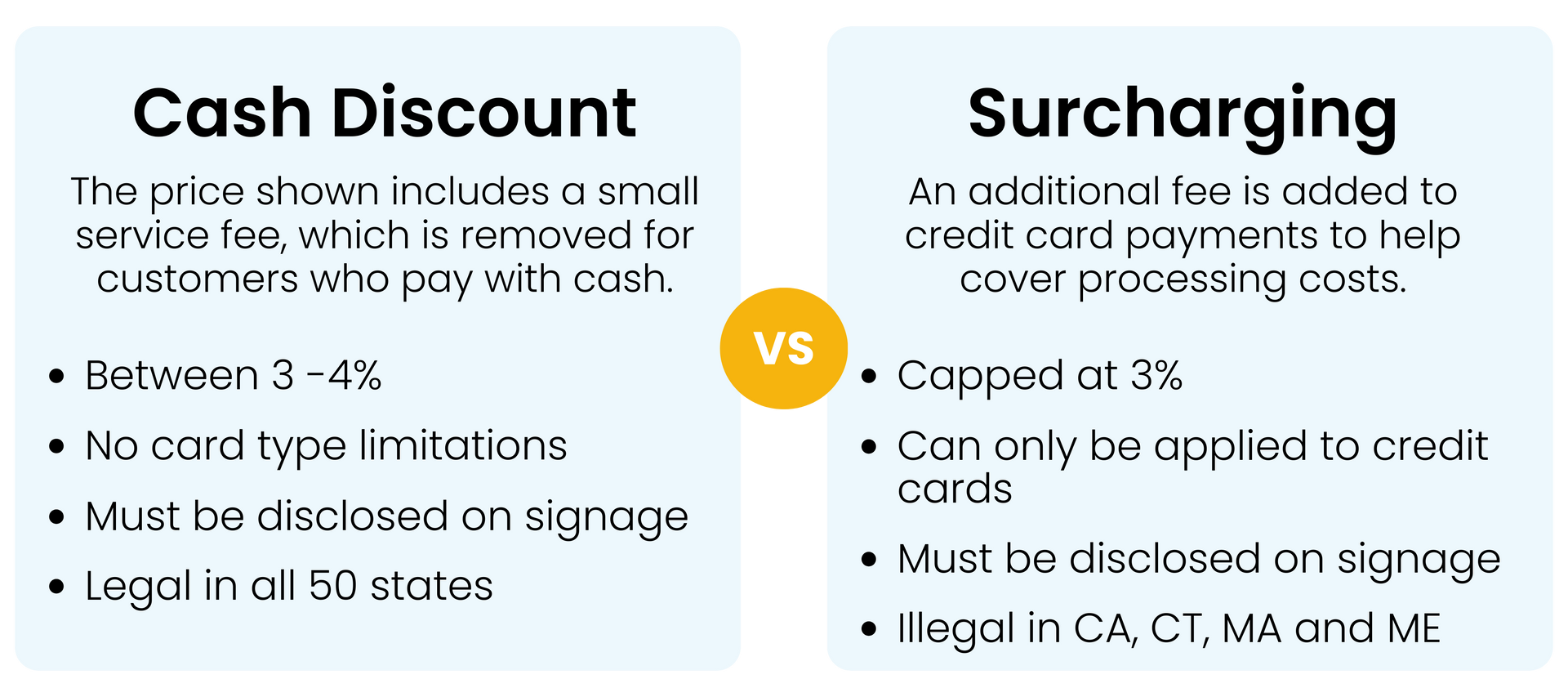

What if I'm interested Cash Discounting or Surcharging?

If you're looking to offset processing costs, we also offer:

- Cash Discounting – Encourage customers to pay with cash by offering a discount. Card-paying customers pay a small service fee, effectively covering your processing cost. This is fully compliant when implemented correctly.

- Surcharging – Add a small fee to credit card transactions only (not debit) to recover processing fees. This is legal in most states and must follow specific card-brand rules.

Both programs are designed to help you eliminate or drastically reduce your credit card fees. We’ll guide you through setup and compliance to ensure a smooth implementation.

How much customer support will I have access to?

We don't believe in voicemail at PPC, which means you'll talk to a real person every time. Our New York based support team is available by phone and email Monday through Friday from 8am to 5pm. We are here to help with everything from onboarding to chargebacks. We pride ourselves on personal, responsive service.

Will I be locked into a long-term contract or have to pay a cancellation fee?

No. We offer month-to-month agreements with no hidden cancellation fees. Our clients stay with us because they’re happy—not because they’re locked in.

How do I get started?

Easy! Just fill out our contact form or give us a call at 585-249-0110. We’ll walk you through a quick needs assessment and set up a free cost analysis with no strings attached.